Steady momentum has defined 2025, with firm foundations supporting stability in the housing market. Prices remain steady, with consistent gains expected through the year. Sustained summer demand has underpinned this momentum, though price sensitivity, softer economic conditions, and policy uncertainty may temper growth.

Bank of England Rate Cuts and Inflation Outlook

In August, the Bank of England cut the base rate to 4%, the lowest level in over two years. Rates have now been reduced five times since last August, bolstering buyer and seller confidence. However, a split vote at the latest meeting has clouded prospects for another cut previously expected in December 2025. Further reductions remain likely, but the pace is uncertain, particularly given persistent inflation.

Inflation stood at 3.8% in the 12 months to July 2025, driven largely by higher airfares and food costs. The Bank of England expects inflation to peak at 4% in September before easing gradually to its 2% target in 2027.

Mortgage Rates and Remortgaging Activity

Following August’s rate cut, mortgage rates have edged down. The average two-year fixed deal now sits at 4.25%, down from 4.99% a year ago, while the five-year fixed stands at 4.18%, down from 4.49%. Swap rates, which influence fixed-rate mortgage pricing, dipped ahead of the August meeting on expectations of further cuts, fuelling competition in the mortgage market, with some products as low as 3.7%.

While mortgage rates are aligning with the Bank’s reductions, a significant drop looks unlikely. According to UK Finance, around 900,000 fixed-rate deals will expire in the second half of 2025, adding to re-mortgage activity.

Autumn Selling Season Gains Momentum

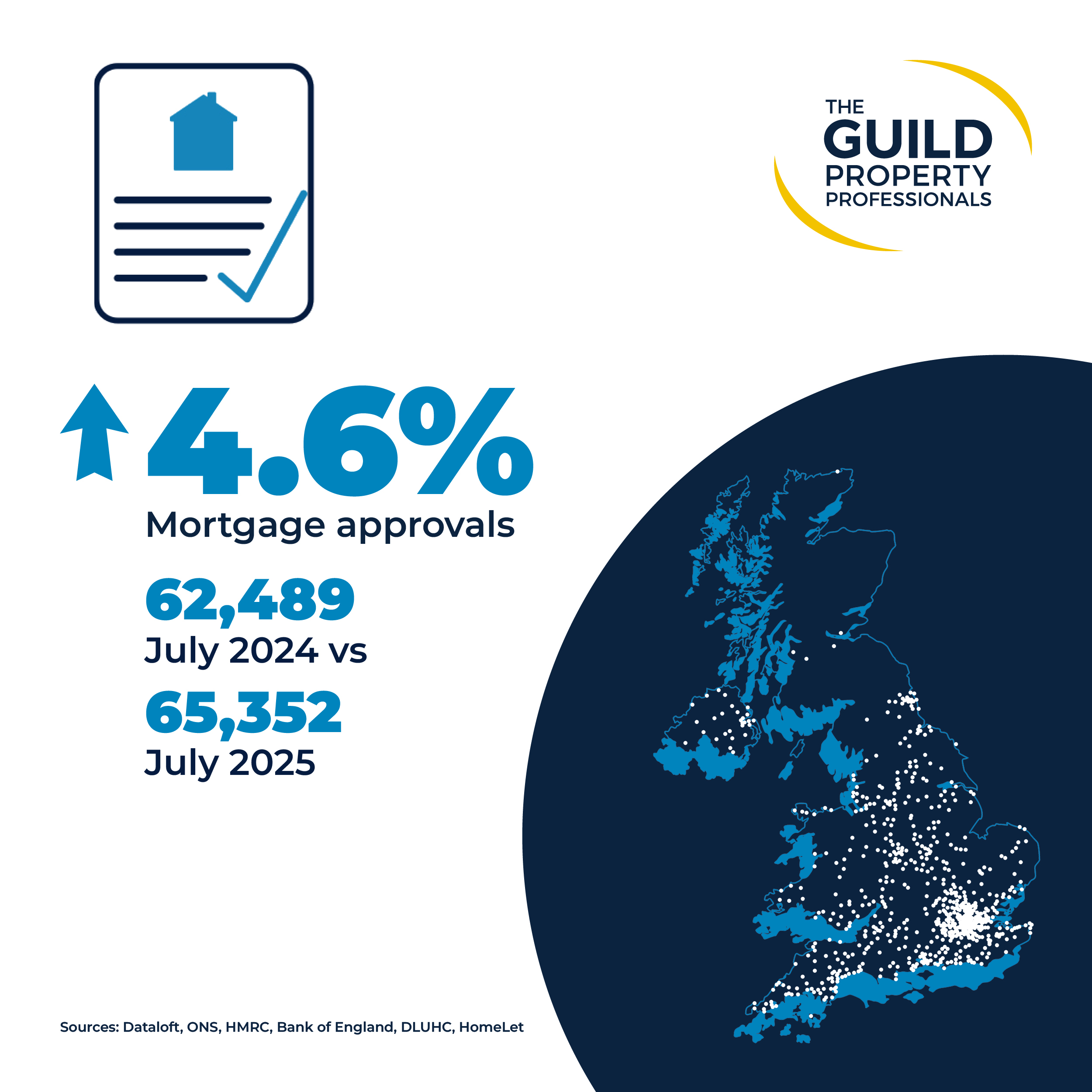

September marks the start of the busy autumn selling season. Despite the usual summer lull, demand has remained firm, supported by easing rates and wider choice. Zoopla reports that buyer demand is up 4% year-on-year. HMRC data shows mortgage approvals rose for the third consecutive month, reaching 65,352 in July, 4.6% higher than last year.

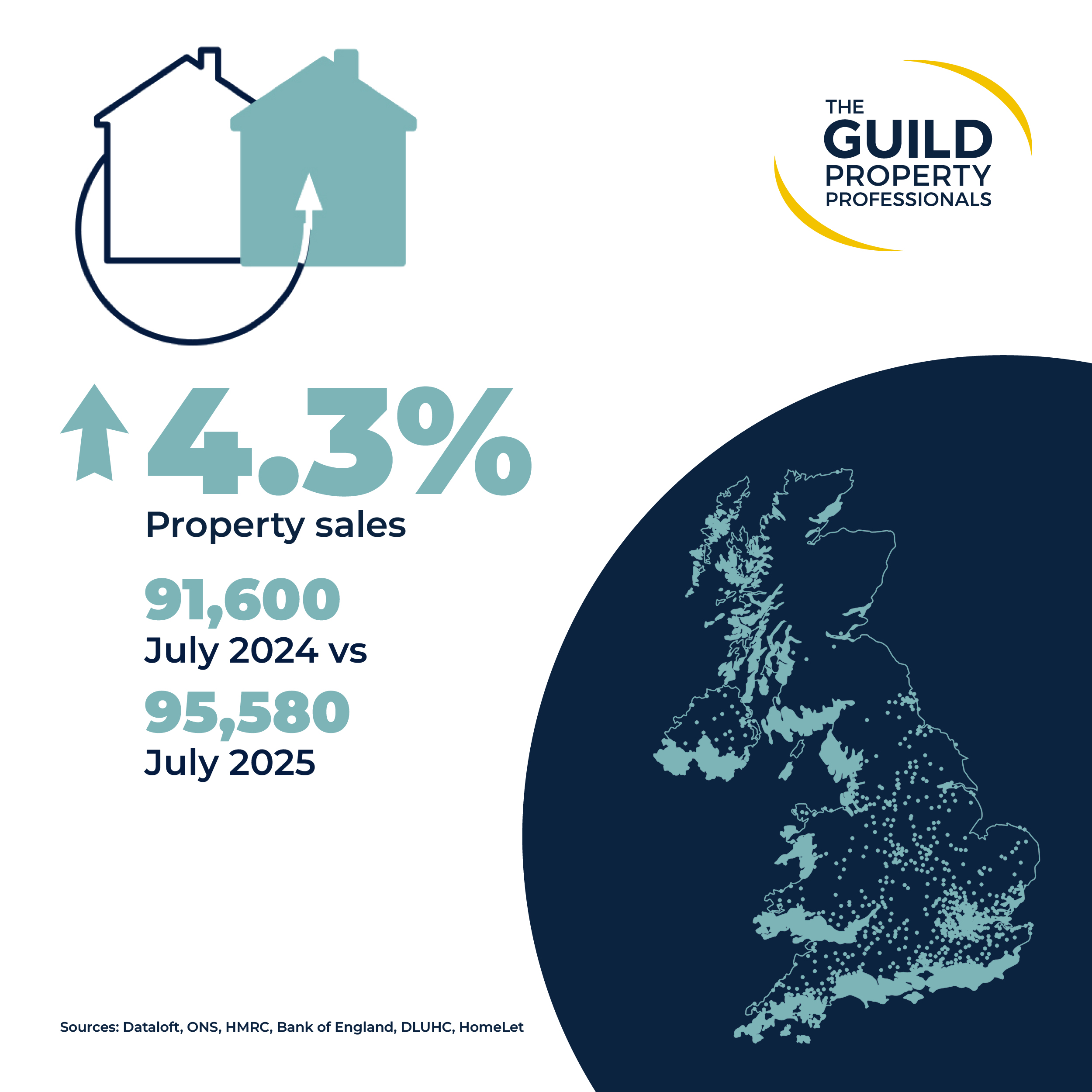

Residential property transactions also gathered pace, with 95,580 completed in July, up 4.3% year-on-year and 5% above the five-year average. While economic policy may temper these seasonal trends, realistic pricing remains crucial, and the overall outlook for the housing market is remarkably steady.

Seasonal Patterns in Property Transactions

Autumn typically sees a pick-up in completions, with the season accounting for 24.7% of transactions, slightly ahead of summer’s 24.2%. After the summer holidays, buyers often return to the market, and sellers aim to complete before Christmas and colder weather.

Over the past five years, sales have risen by an average of 17% between August and September as schools return and households refocus on moving plans.

Policy Uncertainty and Potential Tax Changes

In recent weeks, a series of potential housing tax changes have been floated ahead of the Autumn Budget. Proposals include abolishing stamp duty in favour of an annual levy on homes, and applying Capital Gains Tax to main residences valued over £1.5m.

These remain draft ideas, with no clarity yet on which, if any, will progress. As with any policy shift, the uncertainty risks short- to medium-term disruption as buyers and sellers adopt a wait-and-see approach.

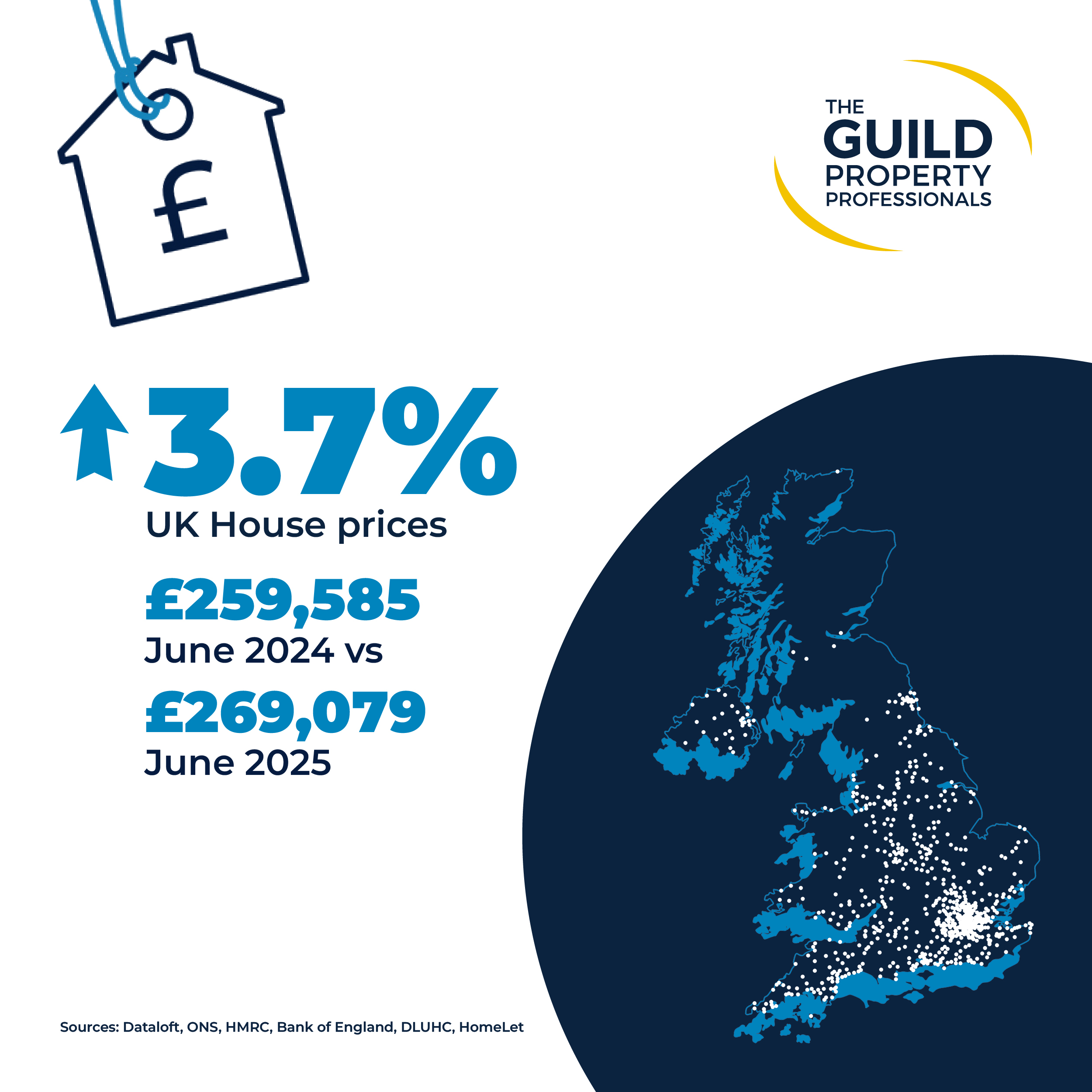

House Price Growth and Forecasts

So far this year, the market has shown resilience. The ONS reported that the average house price reached £269,079 in June, a 3.7% annual increase. Looking ahead, higher supply levels, geopolitical uncertainty, and a softer economy point to steady growth through the rest of the year.

Forecasts now expect house prices to end 2025 with a 2.7% rise, slightly below the 3.3% projected late last year. Growth is forecast to strengthen to 4.0% in 2026, with cumulative gains of 22.4% by 2029, supported by firmer conditions, rising wages, and more flexible mortgage rules.

Pricing Strategies and Selling Times

While many sellers are pricing sensibly, 34% of homes have still seen reductions. With greater buyer choice, realistic pricing is vital to secure a sale. Currently, the average time to find a buyer is 62 days. Homes without a price cut sell in just 32 days, compared with 99 days for those that do.

Regional Variations and Market Outlook

Market buoyancy is evident, with sales agreed rising across all UK regions except Inner London over the past year. A wider choice of available properties, combined with price growth running below the pace of average earnings, is supporting affordability and sustaining steady activity.

Momentum looks set to continue into the year-end, though ongoing uncertainty around policy, particularly taxation, may introduce caution. Regional variations also remain, with affordability-stretched markets showing slower growth.

Take a look at the full Property Market Reports for Wales or the West Midlands.

For more information, or to book a market appraisal for your property, contact your local MMP branch.

How Much is Your Property Worth?

We know how stressful and expensive moving home can be so we are here to help your next move go smoothly by providing you with a free, instant valuation.

Request a Valuation